Curator onboarding

Bonding Curves.

With the establishment of curation markets in The Graph Ecosystem, a whole new world of possibilities will be opening up. The new opportunity to participate in the network as a curator comes with many exciting adventures but also with potential risks. Time to polish up our knowledge of bonding curves to be optimally prepared for the day when curation goes live.

What is a Bonding Curve?

Let’s start with a quick definition of what a bonding curve is:

From this defintion follows:

The reasoning behind the increase in price is that the freely available supply is reduced with every unit that is acquired. The mechanism of a bonding curve rewards the earliest investors with higher profits.

The same holds true for a decrease in the supply of an asset:

The Basic Bonding Curve.

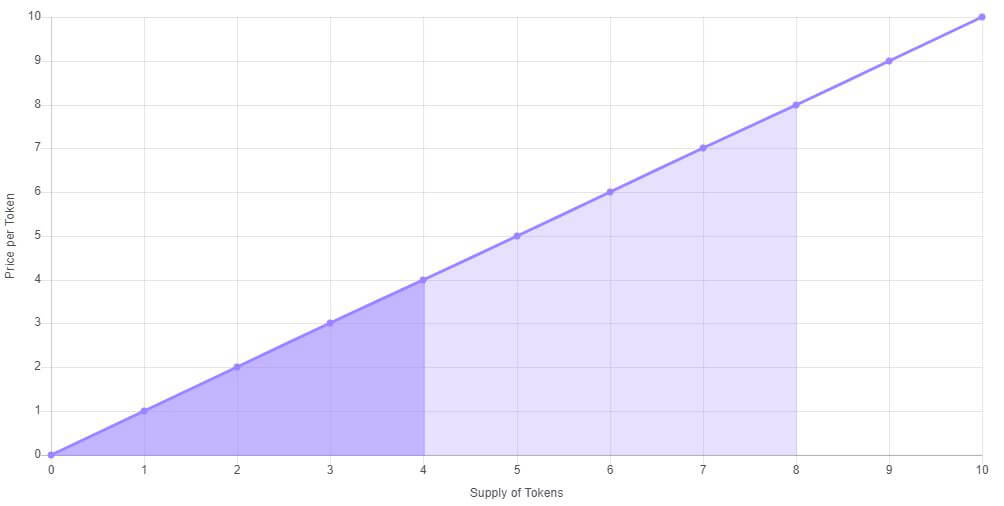

As can be seen in the diagram below, the basic bonding curve is linear. It has a straight line and an increase in distributed tokens leads to a proportional increase in price:

The basic bonding curve is an increasing linear curve, as seen above. In the context of token issuance, this means that tokens are a lot cheaper when the issued supply is low. Conversely, if the issued supply of a token is high, the price per token is higher than it was during the time when the supply was low.

Basic Bonding Curve Interactions.

“Buying up” a bonding curve means that you mint new tokens, which increases the token supply. This subsequently leads to an increase in price. The same holds true when you “sell down” a bonding curve. When selling tokens, you are burning tokens, which reduces the token supply and decreases the price subsequently.

The following example of a basic bonding curve interaction visualizes this concept:

As you can see in this example, the token price doubles with a doubling of the token supply. Likewise, a reduction of the supply by half also reduces the price by half.

Bonding Curve Contracts for Token Issuance.

With the emergence of cryptocurrencies and smart contracts, the concept of bonding curves saw its implementation for bonding curve contracts. These token issuance smart contracts enable users to buy tokens outside of exchanges. The contract calculates the asset price in Ether and sells the tokens to buyers while at the same time buying the tokens and paying for them with Ether. The rate for both of these transactions is defined by the smart contract, which calculates the average price of the token.

The number of tokens issued via a bonding curve contract is not limited by a hard cap. However, the number of tokens that can be issued is limited by price curve limits and the quantity of existing Ether in the market. In general, the price for a token issued through a bonding curve contract increases as the supply increases through token issuance.